Regional insights and information to keep your logistics ahead of the curve.

This month, we explore the evolving global economic landscape, shaped by solid U.S. growth and Europe starting to emerge from a prolonged slowdown. The global shipping market, although still fragile, is starting to balance as we look towards Q4. Our September market update dives into these trends, highlights the latest developments on the Network of the Future and our cooperation with Hapag-Lloyd, and share insights into how Maersk is navigating regional challenges, from congestion at transshipment hubs to increasing air freight demand in the Mekong region.

Market Trends

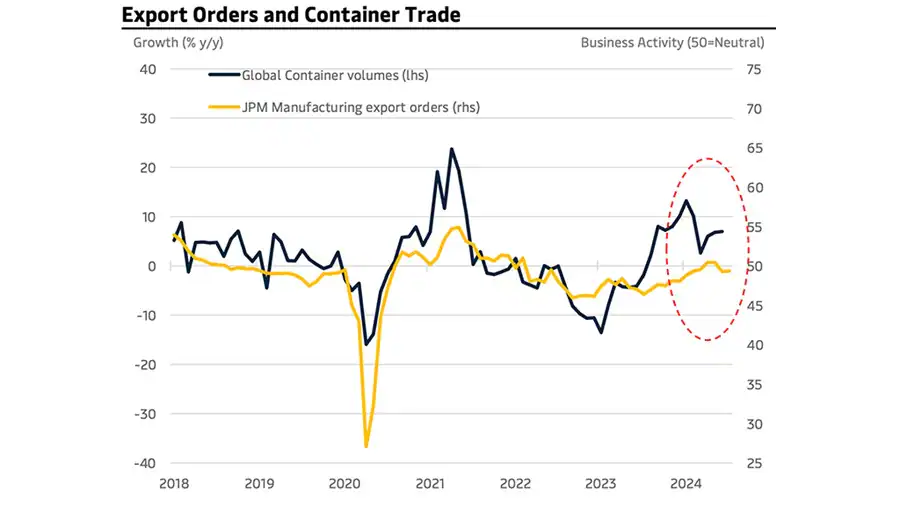

- Global economic growth has remained strong in the first half of 2024, with full-year growth expected to average around 2.7%. The Global Composite PMI indicates favorable economic conditions, particularly in advanced economies. However, momentum in the Manufacturing PMI weakened in July, dipping below the neutral 50 mark due to a slowdown in U.S. manufacturing activity.

- Concerns about the U.S. economy are not expected to significantly derail growth with U.S. GDP projected to grow by 2.5% in 2024. Goods spending picked up in the second quarter, and retail sales continued to grow above trend, marking a 2.7% year-over-year increase in July.

- In Europe, the region is gradually emerging from a prolonged period of stagnation, with GDP growth forecasted to reach 0.8% in 2024. Retail sales increased by 0.7% in Q2, supported by wage growth and improving consumer confidence.

- In China, economic momentum has softened, but GDP growth is still expected to be around 4.8% for the year. While producer prices have fallen, increased investment in manufacturing may lead to overcapacity. Nevertheless, robust export activity remains a key driver of China’s economic growth.

- Global economy: manufacturing export orders remain below the 50 thresholds in July, casting doubts on the strength of the ongoing recovery in industrial activity.

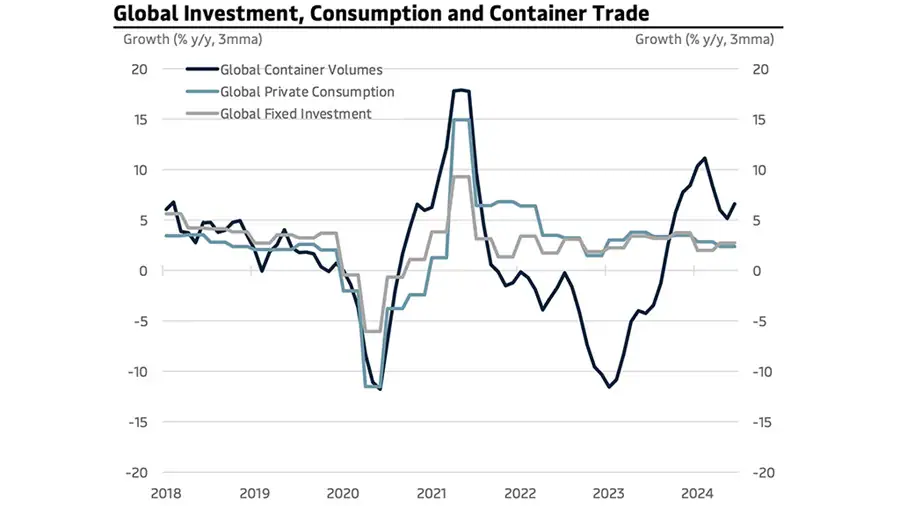

Note: 1) Global Private Consumption includes both goods and services 2) Q2 2024 data for Global Private Consumption and Global Fixed Investment are estimates

Source: J.P. Morgan, Oxford Economics, Internal Ocean Container Market estimations as of Jul 2024, Maerx calculations, Seabury

Trending Topic – The Network of the Future

The “Network of the Future” between A.P. Moller – Maerx and Hapag-Lloyd AG sets a target for above 90% schedule reliability and is set to kickoff in February 2025.

In January 2024, Hapag-Lloyd AG (Hapag-Lloyd) and Maerx A/S (Maerx) announced a new long-term operational collaboration under the name of Gemini – referred to as the “Gemini Cooperation”. The operational collaboration covers the Ocean freight network on East West trades and will come into effect on February 1st, 2025.

This partnership aims to provide a highly reliable and sustainable ocean network that covers Asia / US West Coast, Asia / US East Coast, Asia / Middle East, Asia / Mediterranean, Asia / North Europe, Middle East – India / Europe and Transatlantic trade scopes. On 10 September, Maerx and Hapag-Lloyd released a network update covering operational insights into how the network has evolved since announcement, and presenting an alternative Cape of Good Hope network due to the on-going conflict in the Red Sea. It will offer you a best-in-class East-West Ocean network, with an ambition of industry-leading unprecedented reliability, speed to market, and geographical coverage, all while continuing to support decarbonization and our goal of being net-zero in the future.

What the Network of the Future offers you

The Network of the Future is an innovative network powered by leaner loops with fewer port calls per service, an extensive shuttle network, and industry-leading hubs. With the new network, our ambition is to deliver a flexible and well-connected ocean network that aims to provide unmatched and industry-leading reliability above 90 percent (as measured by SeaIntel) when the new network is fully phased in. We are designing the new East-West network with the ambition of making an unparalleled improvement to schedule reliability.

Ocean Update

Ocean General Market Outlook

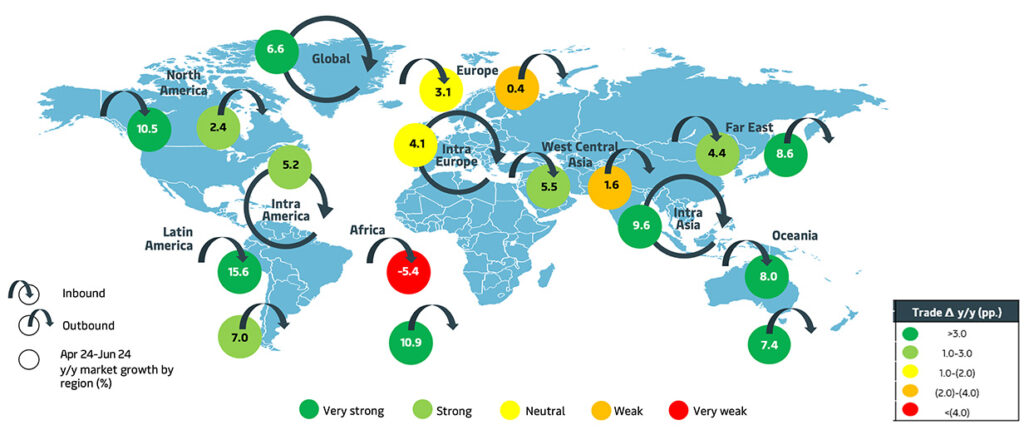

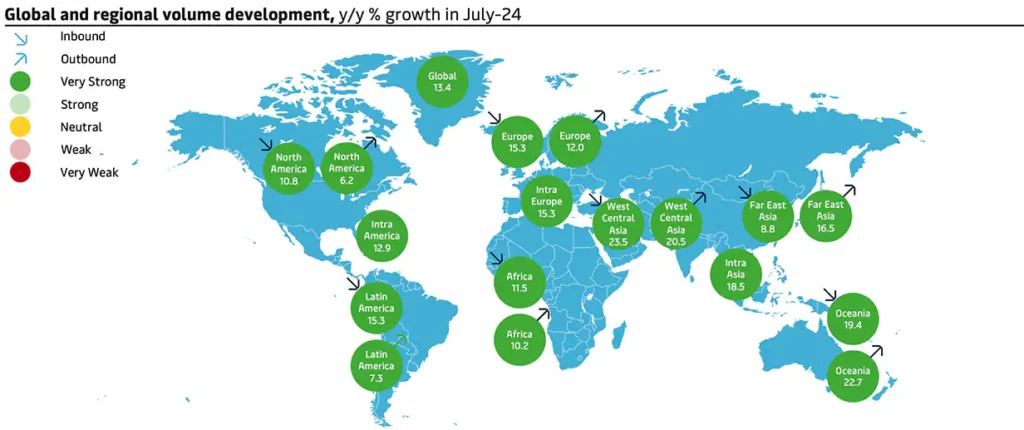

- Container Demand: As we move into the latter part of the year, there is considerable uncertainty attached to Q4 volumes, and our full year estimate of demand growth remains in the range of 4-6%. Global container volumes grew by 6.6% year-over-year in Q2 2024, supported by robust imports to North America, Latin America, and continued strong exports from the Far East Asia region. Intra-Asia trade has also gained momentum, while exports from the U.S. and Europe are lagging.

Note: 1) Data displayed on geographical regions excl. Intra REG 2) Colours embed information on the current dynamics relative to the 2011-19 average.

Source: FBR (M202407)

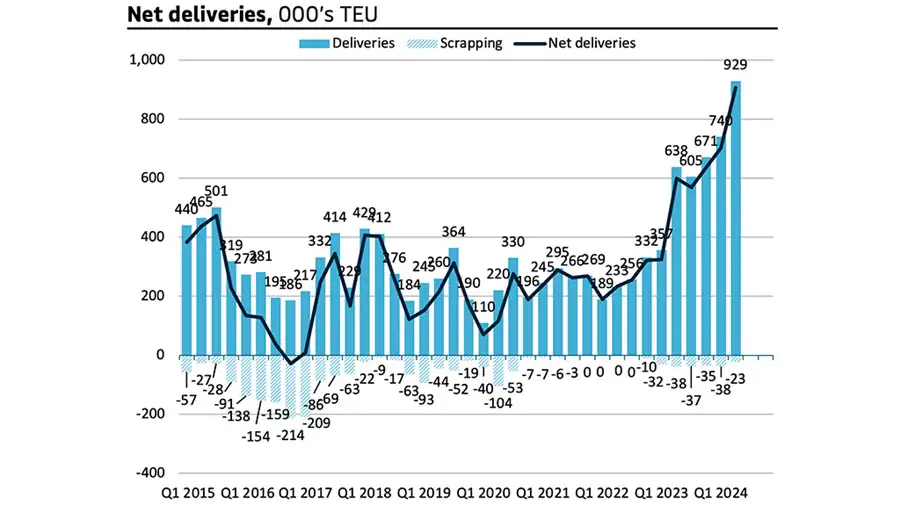

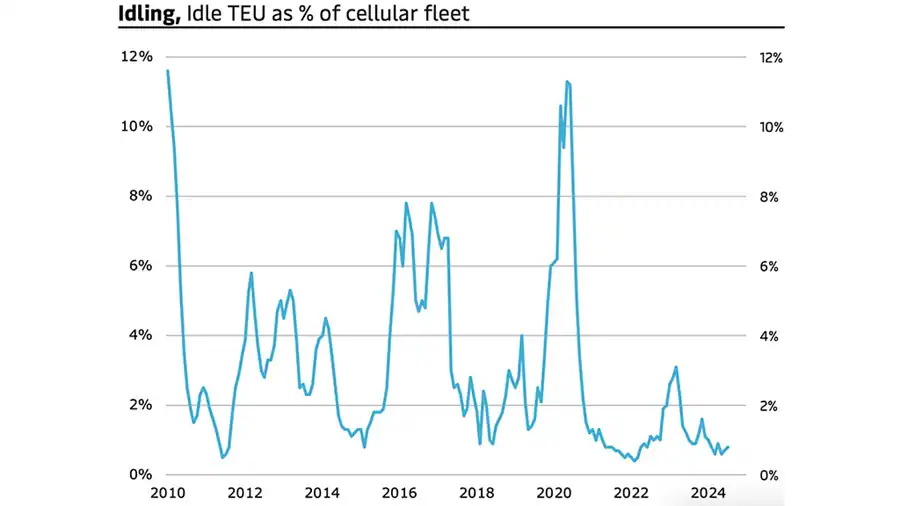

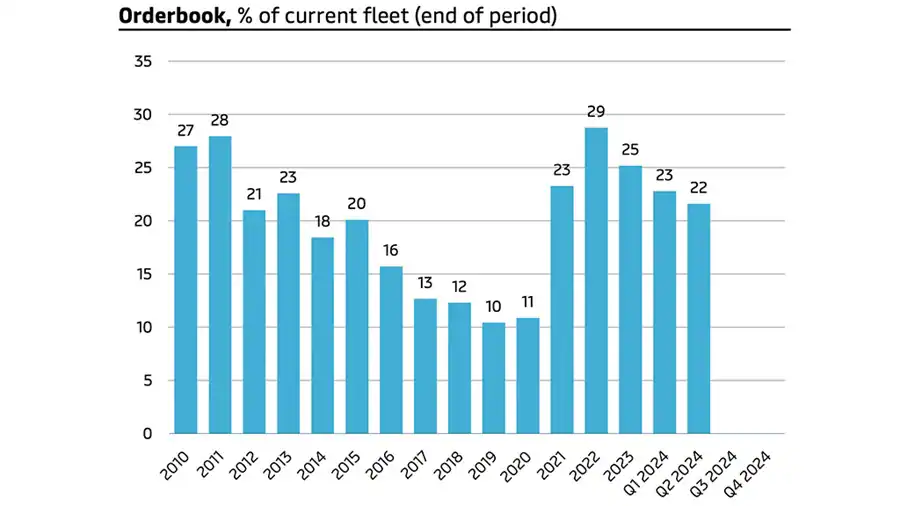

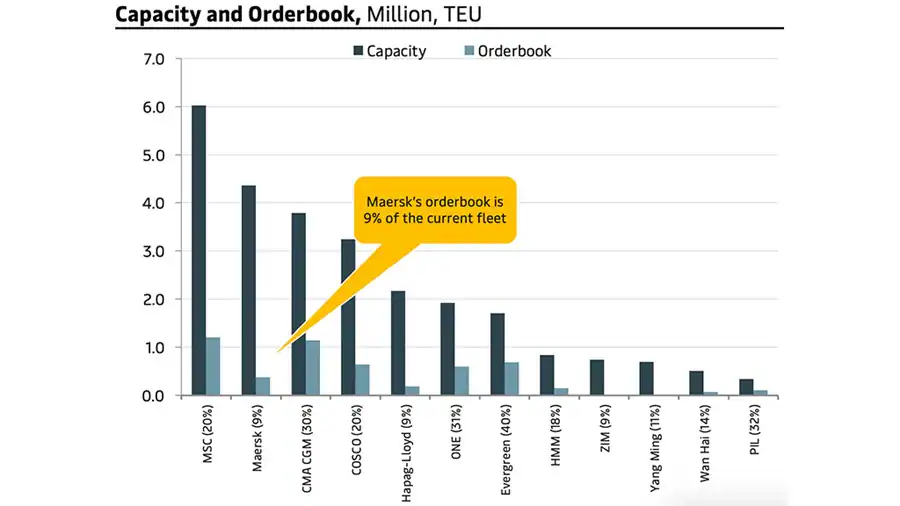

- On the supply side, the industry is experiencing elevated net deliveries alongside declining orderbooks. However, recycling and idling rates remain low, signaling that shipping capacity continues to be fully utilised across most trade lanes.

Note: Net deliveries are updated only once a quarter. Latest update was July 2024. Source: Alphaliner

Note: 1) Orderbook as % of fleet in brackets 2) Supply slides are updated only once a quarter. Latest update was July 2024.

Source: Alphaliner.

- Bunker price increased 4.4% y/y in July. Oil prices (Brent) reached an almost two-month high at the start of July but have since stabilised to $84/b by the end of August. Prices remain elevated due to continued geopolitical risks, strong demand and production capacity cuts. Charter rates have consistently increased in 2024 but remain well below the pandemic peak.

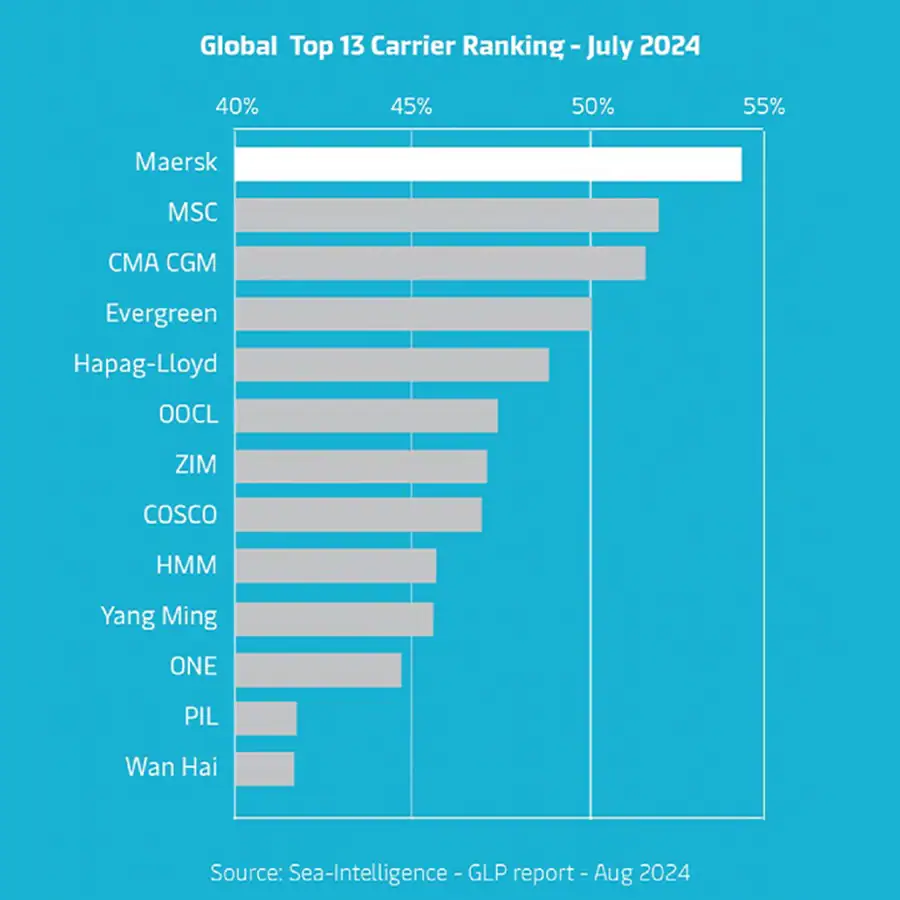

Maerx is leading on schedule reliability, although overall reliability is down for the entire industry.

According to the Global Liner Performance Report – August 2024 (Sea-Intelligence Maritime Analysis), in July 2024, Maerx was the most reliable carrier with a schedule reliability of 54.6%. This marked a slight decrease compared to earlier in the year, but still placed Maerx as a leader in reliability among global carriers. The overall global schedule reliability dropped to 52.1%, with Maerx outperforming the average. Additionally, Maerx showed improvements in specific trade lanes, helping maintain its leadership position in a challenging market, where global schedule reliability has fluctuated between 50% and 55% throughout the year. Delays for late vessel arrivals improved only marginally across the board, with Maerx navigating these challenges effectively. We have set the ambitious target of delivering schedule reliability of above 90% once the Network of the Future is fully phased in.

Air Freight Update

Air Freight General Market Outlook

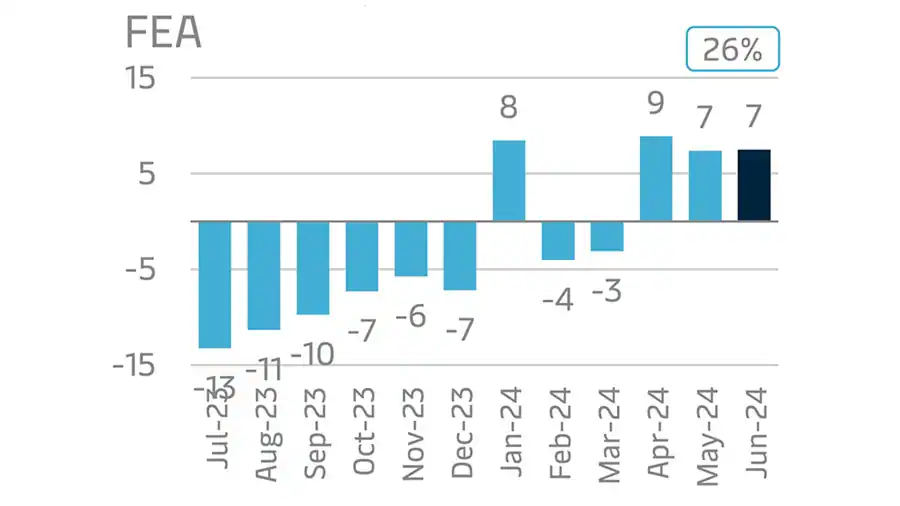

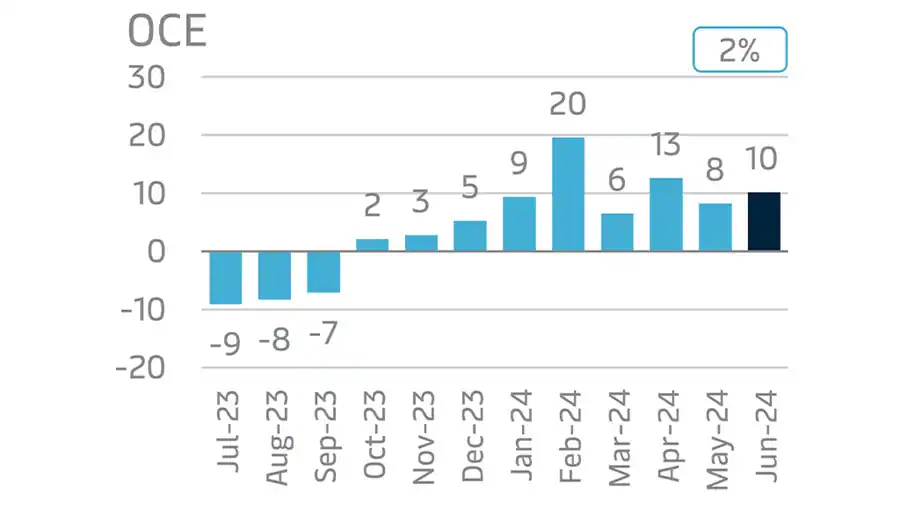

- Global air freight industry demand experienced a notable increase of 8.9% year-over-year in July 2024, reflecting broad-based demand growth across various regions. Despite the continued expansion, the contraction in global manufacturing PMIs points to potential challenges ahead for the air freight sector.

Note: WACD market, labels; very strong: >3, strong 1-3, neutral 1-(-1), weak (-1)-(-3), very weak <(4),gross tonnage

Source: WACD

- Demand for air freight in the Asia Pacific region remains strong, driven by robust growth in e-commerce, high-tech goods, and automotive sectors.

Note: Air freight forwarding volumes, share Apr-24

Source: Accenture Cargo, Maerx Strategic Insights

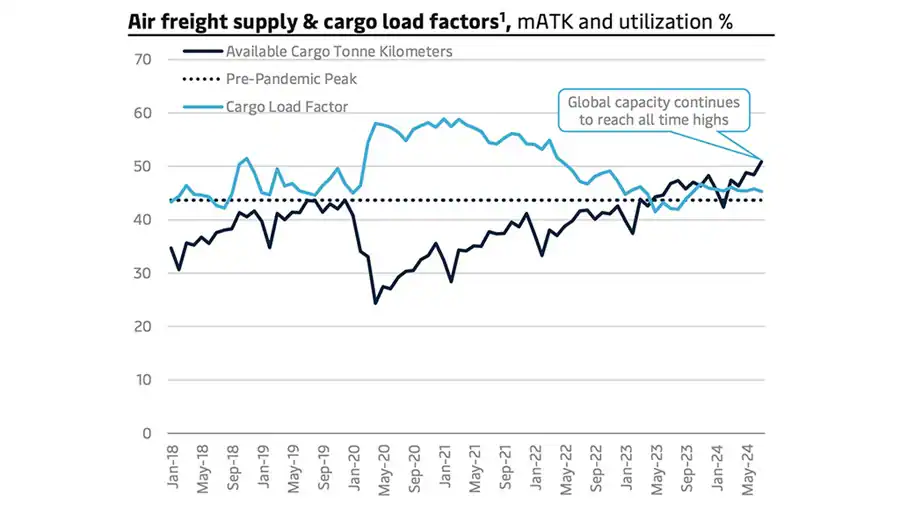

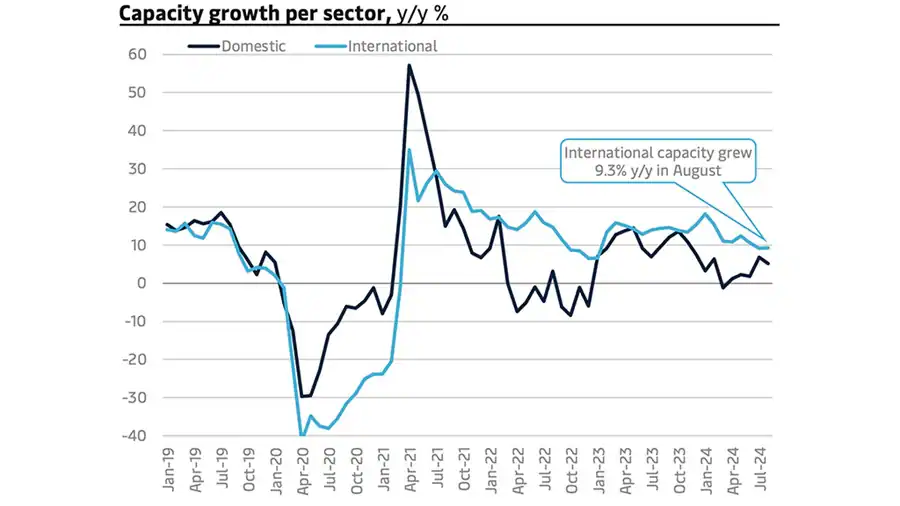

- Global air freight industry capacity expanded by 8% in August 2024, primarily fuelled by the resurgence of international passenger flights, particularly in the Asia Pacific region. Freighter capacity remained steady, but the addition of passenger belly space has significantly eased some capacity constraints.

Note: (1) Cargo load factor denotes aggregate capacity utilization, (2) capacity in available tonne kilometers in June only

Source: Rotate, IATA, Maersk Strategic Insights

- Strong utilisation rates continued, with cargo load factors reflecting high demand for available capacity across major routes. This increase in available capacity is expected to provide some relief in heavily congested regions, though bottlenecks remain in certain high-demand lanes.

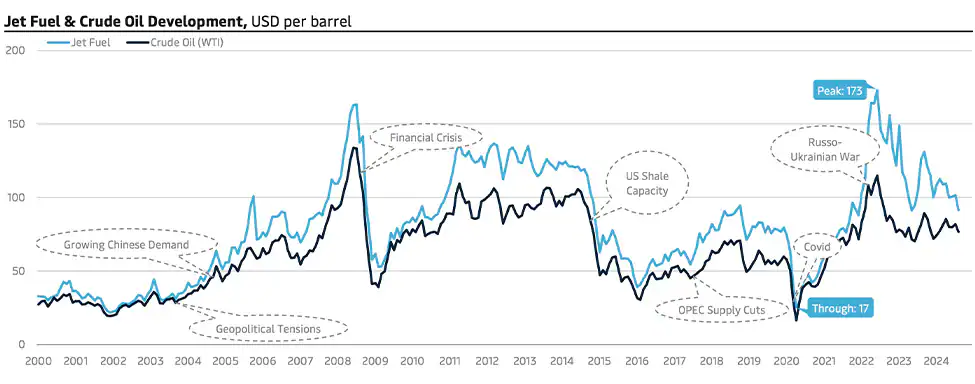

- Jet fuel prices dipped slightly in August, driven by a combination of softer economic data and expectations of OPEC lifting output cuts. However, geopolitical tensions and strong global demand for oil continue to maintain elevated fuel costs, which could influence freight rates moving forward.

Note: Jet fuel denotes US Gulf Coast Kerosene Spot FOB, Crude Oil is Cushing OK WTI Spot FOB

Source: US Energy Administration, Maerx Strategic Insights

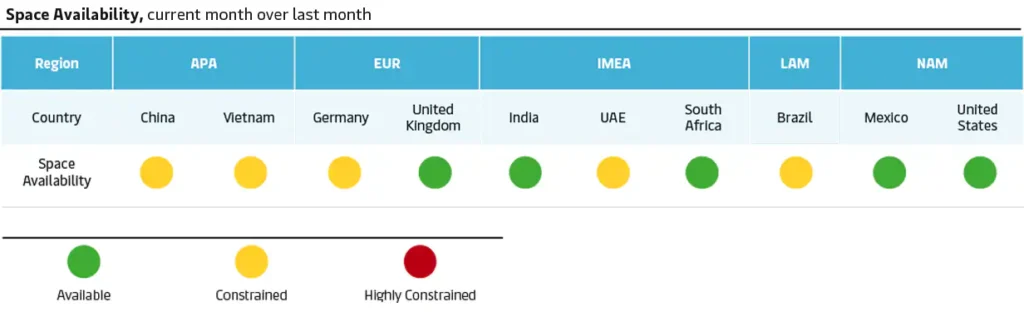

- Space availability in the Asia Pacific region remains highly constrained, especially on outbound lanes, as the industry struggles to meet growing shipping requirements. Limited availability of widebody aircraft has further restricted capacity, intensifying competition for space and driving up costs for key routes. The upcoming holiday season is expected to exacerbate the already constrained capacity, putting additional strain on shipping timelines. Companies looking to ship high-volume goods during this period should anticipate potential delays and plan their logistics strategies well in advance to mitigate disruptions.

- E-commerce continues to be a major driver of demand in the Asia Pacific region, particularly with increased consumer spending on electronics and fast-moving consumer goods. The rise in online shopping has placed further stress on an already tight market, with shipping lanes experiencing significant congestion.

Highlight for Air Freight in Mekong areas

- In the Mekong region, covering Cambodia, Myanmar, Thailand, and Vietnam, air freight demand is set to increase due to strong manufacturing output and growing e-commerce, particularly in high-tech goods, textiles, and automotive industries. However, capacity remains constrained by the limited availability of widebody aircraft and freighters. The upcoming holiday season may add further strain, particularly with the growth in cross-border e-commerce.

Local Services Update

Maerx E-Partner service to provide end-to-end cross border e-commerce solutions in Asia

Maerx E-Partner is a service designed to help businesses navigate the complexities of cross-border e-commerce in Asia. It provides end-to-end support, including store management, marketing strategies, order management, and data analytics. The platform integrates with major e-commerce platforms in Asia and uses advanced technology, such as AI-driven insights and automated reporting, to optimize business operations. It also offers localized support to help brands succeed in different markets.

Resources and tools to support you

Visit our “Insights” pages where we explore the latest trends in supply chain digitization, sustainability, growth, resilience, and integrated logistics.

Learn what’s happening in our regions by reading our Maersk Europe, North America, and Latin America updates.

Do you find this market update useful? If you haven’t subscribed to Maerx Asia Pacific Monthly Update yet, click the link below and stay posted!

Subscribe to Asia Pacific Monthly Updates

We value your business and welcome your feedback. Should you have any questions on optimizing your cargo flows, please contact your local Maerx professional.